While credit reports are a laundry list of your credit accounts, payment history and other information, your credit score - typically called a FICO score, named after the company that developed it, Fair Isaac & Company - is one number between 300 and 850. The higher your number, the better the chance you will make your loan payments and make them on time, lenders believe. It's much easier for lenders to look at this number than cull through your credit reports to come up with their own risk evaluation. |

|

What's in a score?

About 60 percent of people have credit scores of 700 and above. The best number to have is 720 or above. If your score is 720, there's really no need to try and raise it because lenders lump you in the same category as folks with a score of say 800 or 820. At 720, you are viewed as a safe risk and typically receive a loan without problem and at a low interest rate. However, if your number is below 700, it's definitely worth your time to try and pump it up.

|

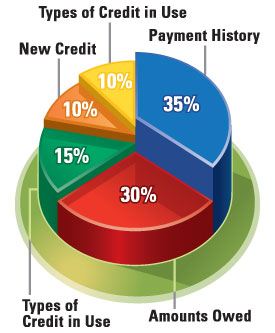

- 35 percent Payment History: "Having a long history making of payments on time and no missed payments on all credit accounts is one of the most important items lenders look for."

- 30 percent Amount Owed: "This measures the amount you owe relative to the total amount of credit available. Someone closer to maxing out all their credit limits is deemed to be a higher risk of late payments in the future and this can lower their credit score."

- 15 percent Length of Credit History: "In general, a credit report containing a list of accounts opened for a long time will help your credit score. The score considers your oldest account and the average age of all accounts."

- 10 percent New Credit: "Opening several new credit accounts in a short period of time can lower your credit score. Also multiple credit report inquiries can represent a greater risk, but this does NOT include any requests made by you, an employer or by a lender who does so when sending you an unsolicited, "pre-approved" credit offer. Also, to compensate for rate shopping, the score counts multiple inquiries in any 14-day period as just one inquiry."

- 10 percent Types of Credit in Use: "Your mix of credit cards, retail accounts, finance company loans and mortgage loans is considered."

Case Studies - Problems and Solution Case Studies

|

|---|

|

|